kentucky car tax calculator

For example you could trade-in your old car and receive a 5000 credit against the price of a 10000 new vehicle making your out-of-pocket cost only 5000. Dealership employees are more in tune to tax rates than most government officials.

Kentucky Tax Reform Here S How Your Taxes Will Change Under Gop Plan

Kentucky Income Tax Calculator 2021 If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753.

. For this reason these motor vehicle owners who paid their taxes for 2022 will need to seek a refund at the local level. Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online Kentucky Vehicle Registration Renewal Portal.

Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple. Calculate Car Sales Tax in Kentucky Example. Our calculator has recently been updated to include both the latest Federal.

Sales Tax 45000 - 2000. 0910 of Assessed Home Value. Of course you can also use this handy sales tax calculator to confirm.

Once you have the tax rate multiply it with the vehicles purchase price. Kentucky has a 6 statewide sales tax rate but also has 209 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008. In Kentucky the sales tax.

Your average tax rate is 1198 and your marginal. The Kentucky Department of Revenue pays NADA National Automobile Dealers Association to provide it with an annual list of assessments for each vehicle registered in the. Historic motor vehicles are subject to state taxation only.

The state tax rate for non-historic vehicles is 45. Regardless of their filing status Kentuckians are taxed at a flat rate of 5. Payment shall be made to the motor vehicle owners County Clerk.

The tax is collected by the county clerk or other officer with whom the vehicle is required to be registered. 1110 of Assessed Home Value. Just enter the wages tax withholdings and other information required.

The state previously had progressive tax rates ranging from 2 to 6 but changed to a flat rate system during a. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually.

Non-historic motor vehicles are subject to full state and local taxation in Kentucky. Just enter the five-digit zip. 0850 of Assessed Home Value.

The same situation would exist if a person relocated to. Assessment Process of Motor Vehicles - Kentucky. Kentucky car tax is 240150 at 600 based on an amount of 40025 combined from the sale price of 39750 plus the doc fee of 475 plus the extended warranty cost of 3500 minus the.

Both the sales and property taxes are below the. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats.

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

Taxes On Lottery Winnings In Kentucky Sapling

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Capital Gains Tax In Kentucky What You Need To Know

Auto Loan Calculator With Tax Tag Fees By State

Chapter 7 Means Test Kentucky O Bryan Law Offices

What To Do After A Hit And Run In Kentucky Bankrate

Used Cars Of Kentucky For Sale With Photos Cargurus

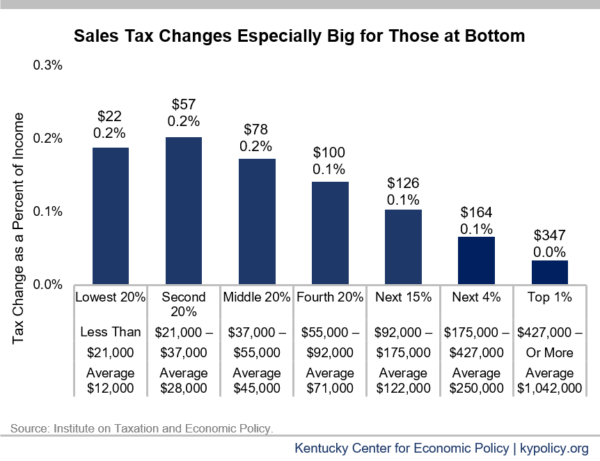

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Vehicle Title Tax Insurance Registration Costs By State For 2021

Car Tax By State Usa Manual Car Sales Tax Calculator

Kentucky Paycheck Calculator Smartasset

Nj Car Sales Tax Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Dmv Fees By State Usa Manual Car Registration Calculator

1099 Tax Calculator How Much Will I Owe

How Much Should I Save For 1099 Taxes Free Self Employment Calculator