property tax assistance program georgia

You may qualify for Clean Energy Property Tax Credits up to 35 or 100000. Property Tax Postponement A State program offered to senior blind or disabled citizens to defer their.

I Want To Purchase A Duplex As Income Producing Property Before The End Of 2014 Maximum Mortgage 100k Month Mortgage Payoff Mortgage Brokers Mortgage Payment

Apply for a Homestead Exemption.

. Apply for Elderly Disabled Waiver Program. Property Taxes in Georgia. You could be eligible for property tax relief in Georgia.

Medicaid waiver programs provide recipients certain services not normally covered by Medicaid. Ad 2022 Latest Homeowners Relief Program. The stated purpose of the act was to provide.

Apply for Service Options Using Resources in a Community Environment. This statewide assistance program may allow up to one half of the annual property taxes to remain unpaid. IRS VITA and TCE Programs.

It plans to issue 12 billion of general obligation bond anticipation notes which will mature in one year and have an interest rate of 38. If you think your homes latest assessment. The Detroit Tax Relief Fund is a new assistance program that will completely eliminate delinquent property taxes owed to the Wayne County Treasurers Office for Detroit homeowners who have.

Property owners can choose to pay 0 full deferral 25 50 or 75 of the delinquent and future property taxes. The State of Georgia was allocated 354 million by the US Department of the Treasury Treasury for the Homeowner Assistance Fund established through the American Rescue Plan Act of. Low-income individuals could get help with the homestead tax exemption in Georgia.

Property Tax Millage Rates. County Property Tax Facts. Property Tax Returns and Payment.

Treasurys Federal Emergency Rental Assistance Program to provide relief to individuals families and landlords. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. Ad All state governments offer assistance to residents that may be struggling.

Look Into a Hardship Program. Of course the homeowner must have been delinquent on paying their property taxes. Georgia property tax relief inc.

Mortgage Relief Program is Giving 3708 Back to Homeowners. The applicant will need to be the owner of the real estate property according to the assessors records. Households are eligible for a maximum of up to 12 months of assistance with past due rent.

The amount may need to be paid ifwhen the home is ever sold in the future. The State of Georgia received 989 million from US. The Homeowner Assistance Fund program is available in each state and United States territories.

Mortgage Relief Program is Giving 3708 Back to Homeowners. Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a. The Homeowner Assistance Fund HAF was established to mitigate financial hardships associated with the coronavirus pandemic by providing funds for the purpose of preventing.

Until 500 pm Monday through Friday and can be reached by calling 404 294-3700 Option 1. Fulton County Georgia has multiple Homestead Exemption property tax assistance programs. Contact the property tax department of your county or the largest local government to ask about hardship programs for property taxes.

These include a Senior Homestead Exemption specific to the county. Check Your Eligibility Today. Check If You Qualify For 3708 StimuIus Check.

Find free access to assistance programs to help you with your bills. You can apply for any arrears that occurred after March 13 2020. With many people out of work due to the coronavirus COVID-19 pandemic the City Department of Finance DOF is offering several programs to assist property owners who are having a hard.

Apply to the New Option Waiver Program Comprehensive Support Waiver Program. AGL Senior Discount Application If you are a Liberty Utilities customer who is 65 years of age or older with a total household income of 24280 or less per year then you are eligible to receive. HUD HHS partner to create housing and services resource center for affordable accessible housing and supportive services.

Check Your Eligibility Today. To access all other clinics Board of Health programs and. Property Tax Homestead Exemptions.

A homestead exemption can give you tax breaks on what you pay in property taxes. The call center is open from 830 am. You might be able to get up to.

The Department of Community Affairs GHFA Affordable Housing Inc. Strategic Industries Loan Program targets Georgias strategic industries and emerging or development. The National Taxpayers Union Foundation estimates that between 30 and 60 of taxable property in the US.

Pritzker has said the state. A homestead exemption reduces the amount of property taxes. The property taxes that have defaulted or escaped during the prior fiscal tax year.

Changes In The Stock Market Are Unpredictable Hence Planning Long Term Investment For A Future Date Becomes Challenging Investing Best Investments Marketing

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia State Sales Tax Georgia State Visit Georgia Georgia

2021 Property Tax Bills Sent Out Cobb County Georgia

5 Property Tax Deductions In Georgia You Should Know Excalibur

S Corp Tax Calculator Tax Consulting Tax Preparation Services Savings Calculator

Tax Deduction Tips For Homeowners In 2021 If You Re A Homeowner Should You Claim A Standard Home Decor Shops Homeowner Home

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

A Guide To Georgia Business Personal Property Taxes

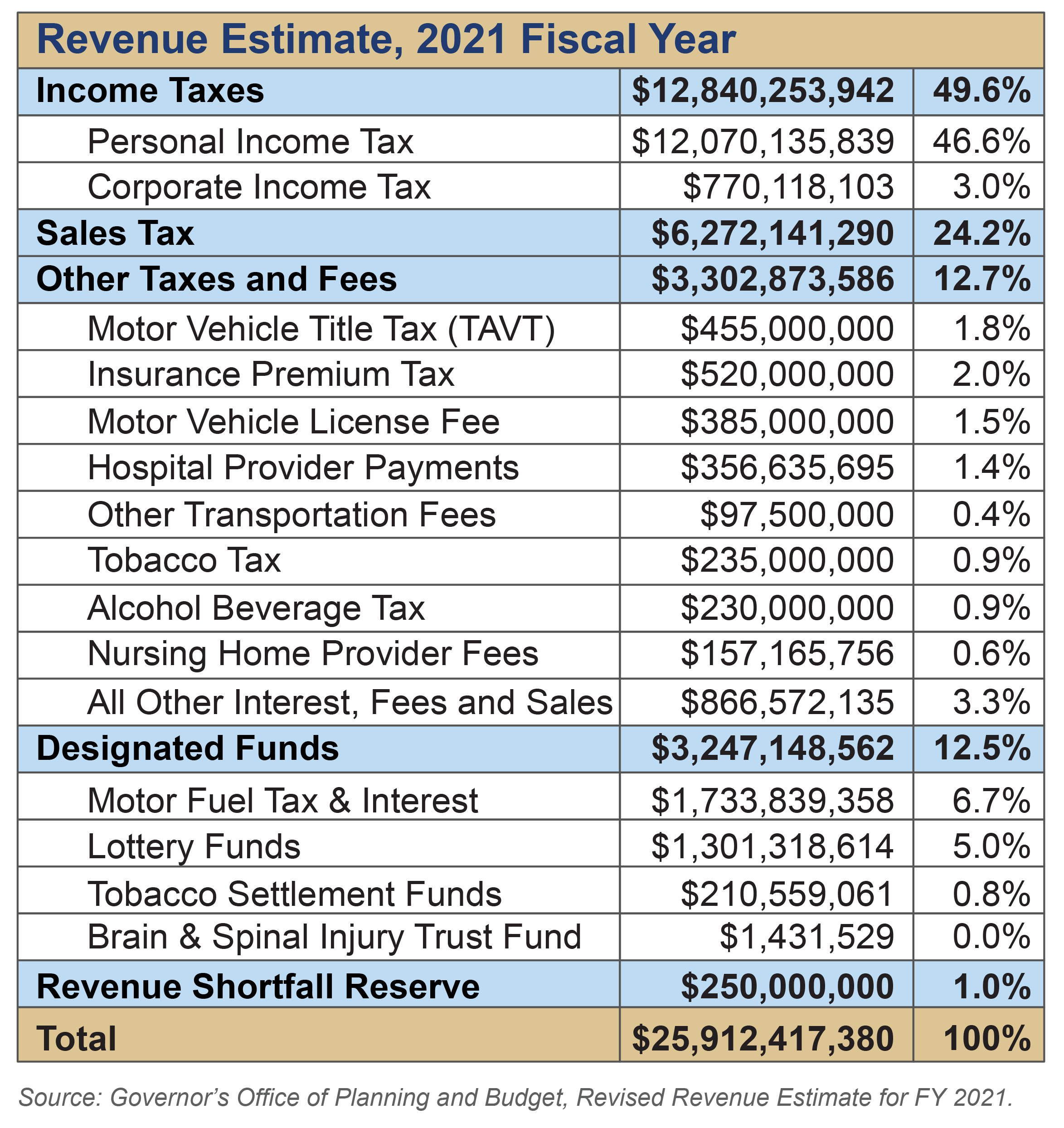

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

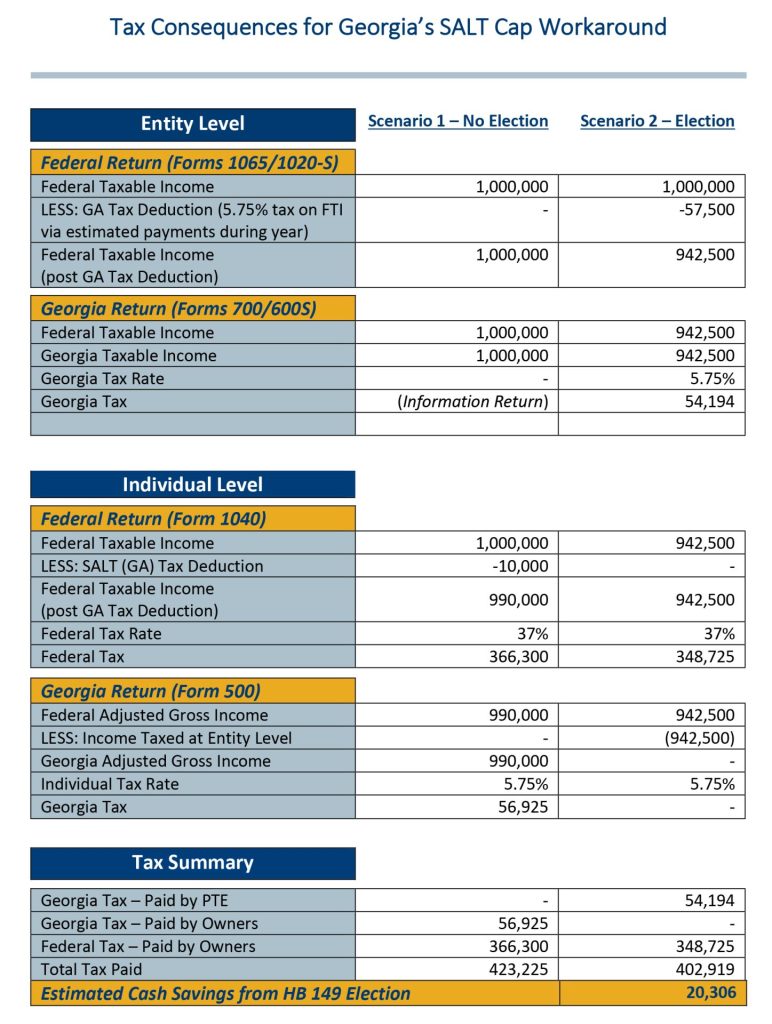

The Benefits Of Georgia S Salt Cap Workaround Bennett Thrasher

A Guide To Georgia Business Personal Property Taxes

Georgia Estate Tax Everything You Need To Know Smartasset

What Is Tax Relief Homeowner Roofing Thunderstorms

Learn More About Georgia Property Tax H R Block

Georgia Revenue Primer For State Fiscal Year 2021 Georgia Budget And Policy Institute