capital gains tax proposal effective date

The effective date for the capital gains hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a. Biden formally unveiled the capital-gains rate hike and other tax hikes geared toward top earners on April 28 while addressing members of Congress.

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

The effective date would be retroactive to April 28 2021 the date President Biden first unveiled his proposals.

. It was after all the Obama administration who raised the tax exemption back in 2012 with The American Taxpayer Relief Act first to 75 for eligible QSB stock acquired after. The effective date for the proposal would be the date of enactment. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April 28 2021.

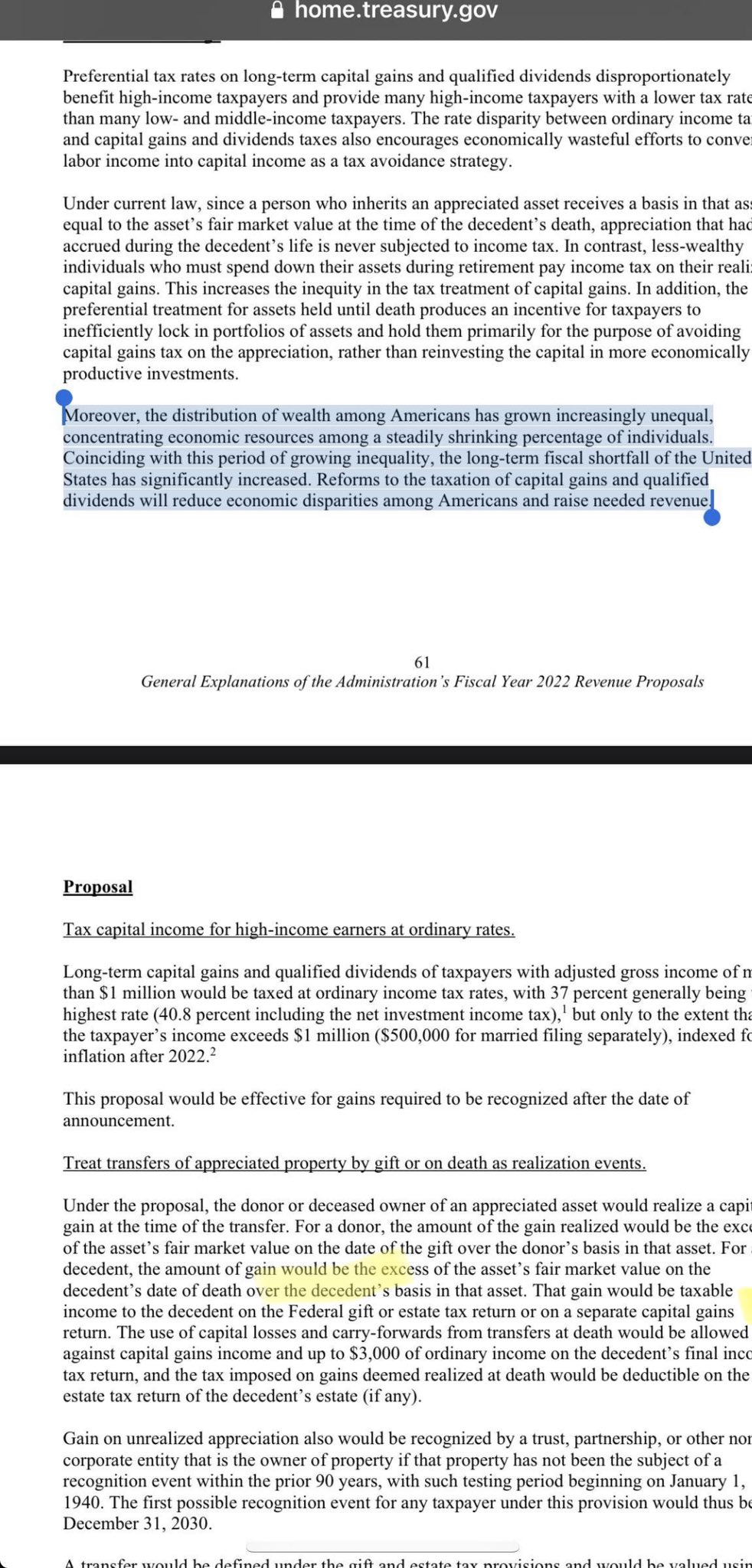

Ive always been thinking in discussing Biden tax policy assuming we have legislative activity this year we would be looking at an effective date of Jan. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1 million effective for all sales on or after April.

If this were to happen it may. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the. In short we dont yet know the answer to this important question.

The Green Book says this. Which leads to the oft-asked question of when. The new rate would apply to gains realized after Sep.

The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a. The actual day of announcement for a capital gains change will be a closely guarded secret beforehand as members and staff will want to avoid a market-moving leak. 1 2022 with some.

This could be the date a proposal is first unveiled in the Treasury Green Book or when formally introduced in Congress potentially sometime from mid-May to mid-June. The top rate would be 288 when combined with a 38 surtax on net investment income. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

President Biden has proposed a substan tial increase in the capital gains rate. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced. The effective date for most of the proposals is Jan.

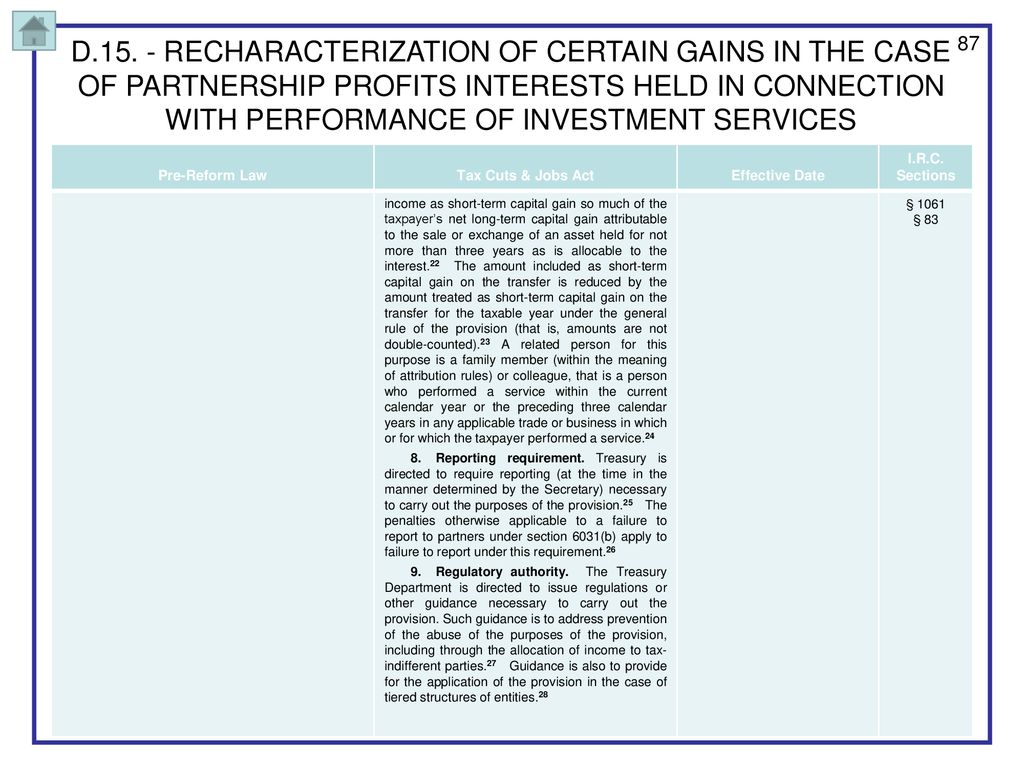

Proposed effective dates on. This proposal would be effective for. In 2022 it would kick in for.

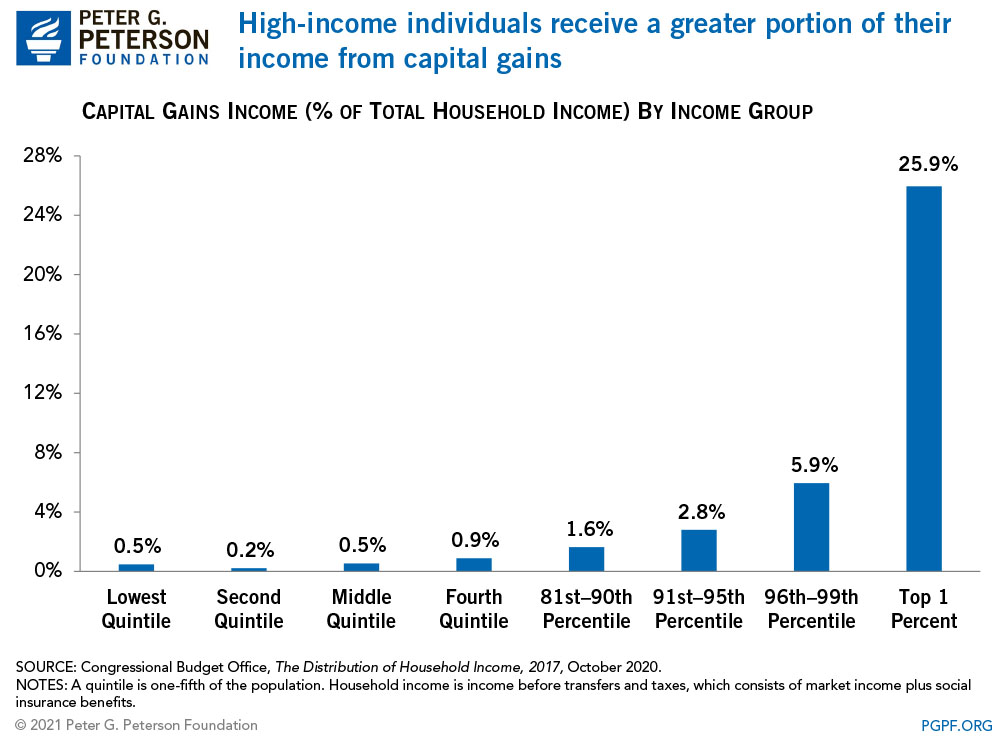

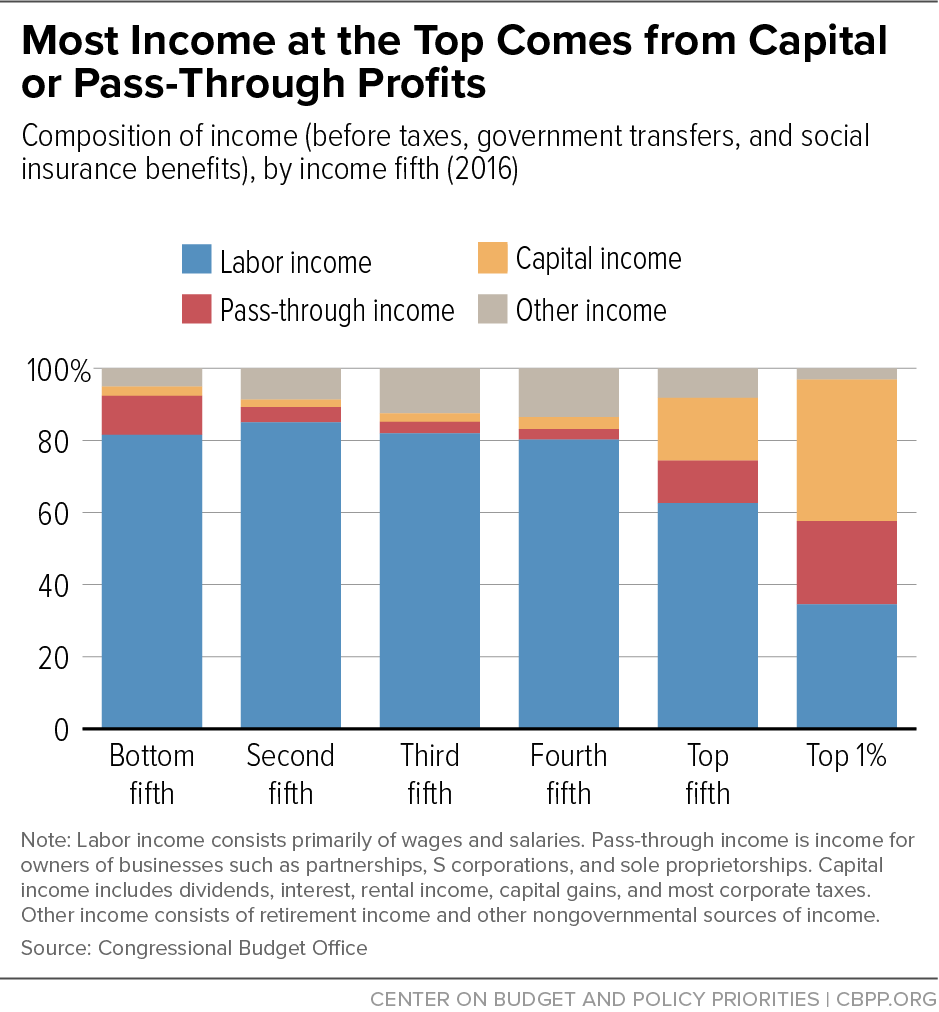

No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the. It would apply to those with more than 1 million in annual income. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income.

Dems eye pre-emptive capital gains effective date. The effective date for most of the proposals is Jan. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396.

Capital Gains Full Report Tax Policy Center

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Dems Eye Pre Emptive Capital Gains Effective Date Grant Thornton

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Biden Plans Retroactive Hike In Capital Gains Taxes So It May Be Already Too Late For Investors To Avoid It Report Marketwatch

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

What S In Biden S Capital Gains Tax Plan Smartasset

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Summary Of Fy 2022 Tax Proposals By The Biden Administration

The Tax Reform Act Where Are We Now Ppt Download

Nomoremrniceguy On Twitter Drjorojo Jhuntermav Rockstar Stocks Question So If I Sell Enough Shares To Bank 999 000 I Won T Have To Pay Capital Gain Taxes On That Amount Twitter

After Fierce Debate Washington State Senate Approves New Tax On Capital Gains By One Vote The Seattle Times

How Are Capital Gains Taxed Tax Policy Center

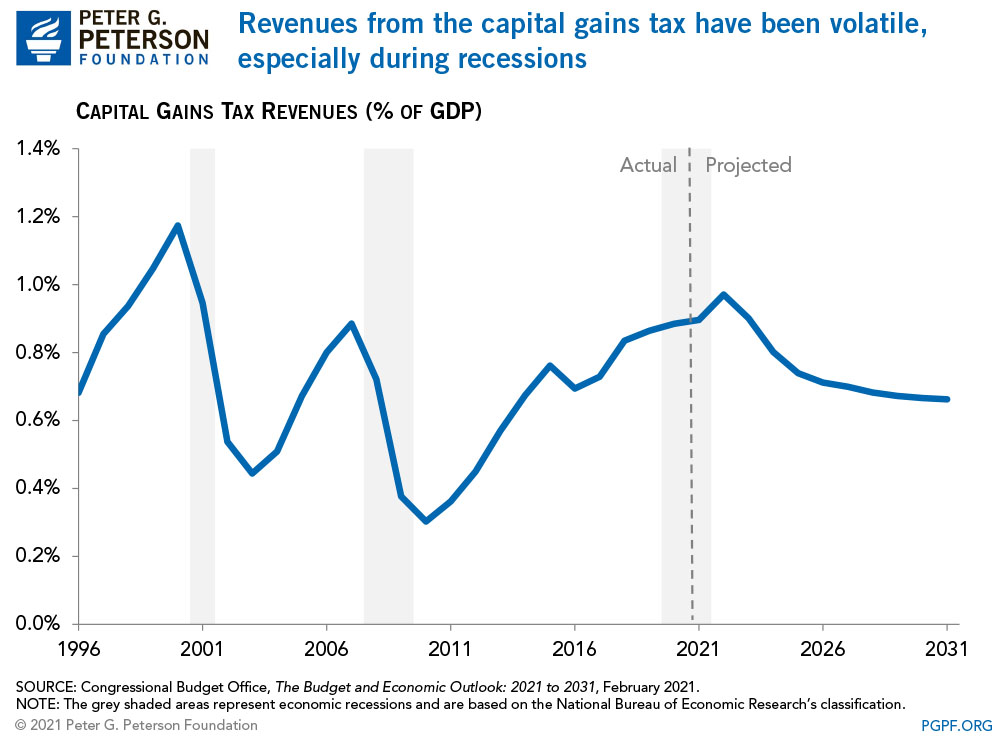

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Summary Of Fy 2022 Tax Proposals By The Biden Administration

When And How Much The Tax Rate On Capital Gains Will Rise Could Become Clear On May 27 When Biden Releases His Budget Financial Planning

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms